Sales Automation

for Mortgage Lenders

We automate 167 hours of database sales per LO every day to deliver ready-to-refi borrowers on a silver platter.

Lenders Lose up to 70% of Recapture Opportunities.

Nurture & engagement tools weren’t designed to sell. And it shows.

Built by a producing mortgage broker.

“The tools on the market didn’t give me the ability to scale high-value borrower outreach, so I built one for myself. Within one year, I was the top-producing LO at APM.”

– Ken Bates, Founder

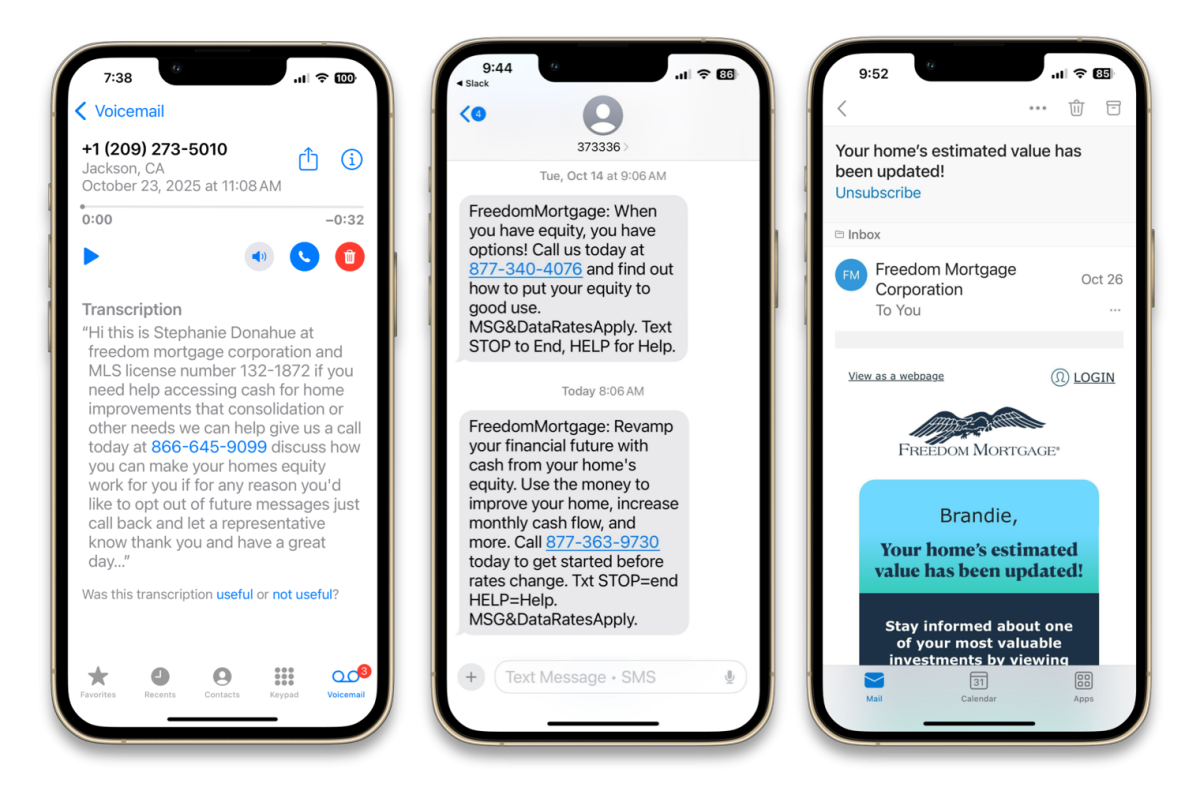

The top 7 seller-servicers have direct, unrestricted access to ~50% of all first lein holders.

And, as the servicer, they have the borrower’s attention.

They consistently market to borrowers to capture cash out and rate-term refis.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Text

- Voice Mail

The access & consistency is a challenge, but their communications lack individual context.

Elements of an "always on" refi sales machine.

Our category-defining platform fuses the most effective capabilities of multiple tools to replicate and automate the sales process from quote to application.

Customer Relationship Management

Customer relationship management. Lorem ipsum dolor sit amet adipiscing.

- Pipeline Monitoring

- Volume Forecasting

- Sales Activities

Marketing Automation Platform

Marketing automation platform. Lorem ipsum dolor sit amet adipiscing elit.

- Lead Scoring

- Drip Campaigns

- Performance Analytics

Product & Pricing Engine (Rate Quote)

Lorem ipsum dolor sit amet adipiscing elit. Ut elit tellus, luctus nec mattis.

- Rate & Price Calculations

- Eligibility Matching

- Scenario Comparison

Customer Engagement Platform

LO Branded engagement platform . Lorem ipsum dolor sit amet adipiscing.

- Personalized Content

- Borrower Nuturing

- Behavior Tracking

Request a demo